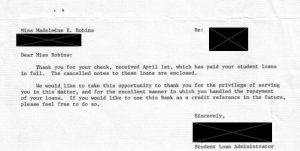

Cleaning out old files (Oh my god, my college papers…) I discovered this: the letter I got from the Bank when I finished paying off my college loans–a little less than ten years after I was graduated from college. If the rather fulsome praise for the “excellent manner in which you handled the repayment” and offers to provide credit references sound…quaint, it’s because they were. The world is a whole lot less forgiving than it was when I took out those loans, and I, for one, don’t think that’s an improvement.

Cleaning out old files (Oh my god, my college papers…) I discovered this: the letter I got from the Bank when I finished paying off my college loans–a little less than ten years after I was graduated from college. If the rather fulsome praise for the “excellent manner in which you handled the repayment” and offers to provide credit references sound…quaint, it’s because they were. The world is a whole lot less forgiving than it was when I took out those loans, and I, for one, don’t think that’s an improvement.

Everything cost less in those days.

I went to a private, top tier college, and between a $3000 loan every year (the maximum amount permitted), and grants from a private foundation, plus work study and summer jobs and typing papers, I was able to cover the entire cost myself. I think my senior year room, board, tuition, and fees came to a little more than $5000; even with travel to and from, and the odd living expense, I was okay. Quaint, right?

But wait, there’s more: at the time I was borrowing, student loan interest was capped at 3%. By law. Which meant that after I graduated (and after the 6-month post graduation grace period) I paid $115 a month. Don’t get me wrong: this was a not insignificant chunk of change for someone in a first job, but I managed it. I took it seriously, because without those loans I would never have been able to go to college, full stop. And fortunately for me, the system was set up to help people go to college, because an educated populace was held to be a societal good.

And then came the 80s, when regulation was evil and the rules around student loans were changed and it became a damned free-for-all. Much the way that mortgages were bundled into “mortgage-backed securities,” student loans were bundled. And because (at a time when interest rates were insanely high) 3% just wasn’t worth the time of day for investors, regulations went out the window and rates went up (these days the cap is somewhere around 8.25% for undergraduate students, and can be as high as 10.50%). An educated populace was all very well so long as Wall Street could get a piece of the action. I worked briefly for an investment bank during this period, in a department that pioneered mortgage-backed securities, and they were conceived as a positive good, a way to help more people to home ownership… while making a profit for the banks, of course (they weren’t saints). Fast forward and we get the great melt-down of 2008.

So along with being white and middle class, I am not only educationally privileged, but privileged in that I came along at a time when the rules were set up to make education more accessible.

TLDR: yes, I paid back my college loans. I was lucky. And I believe that the current systems for paying for higher education are not only punitive, they are suicidal. Anti-regulation people rant about how regulations disincentivize innovation and business… But the current student loan systems disincentivize education at a time when we critically, crucially, desperately need an educated populace. Not everyone wants to–or should–go for academic training. But paying for academic training (or training as a pastry chef or a plumber or an electrician) should not be a life sentence.

I endorse every word of this rant.

I went to a very good state school back when tuition was nominal. My parents had put by a little money for me, and after that I got by on various jobs, some of them through work-study programs, tuition scholarships, and living cheap in group houses, by which I mean my rent was $25-50/month and we ate a lot of cheap hippie health food. I got out of school with two degrees and $600 in loans, which I used to live on while studying for the bar exam and waiting on the results. The upshot: the loans didn’t affect what I decided to do next.

I want everyone to have those options. That includes the people who want to study poetry or art — my BA is in liberal arts and every day I am thankful for that education.